Decarbonizing Heavy Industry: Strategy Report

Summary

- What is heavy industry? Heavy industry is a loosely defined term that generally applies to capital- and energy-intensive industries involving complex production processes, such as cement, steel, aluminum, and petrochemicals. Heavy industry accounts for around one-third of global greenhouse gas emissions but has historically been seen as a hard-to-decarbonize sector. Reasons for this include high heat requirements, decentralized CO2 emissions, low profit margins, high capital costs, increased operating costs, and long infrastructure lifetimes.

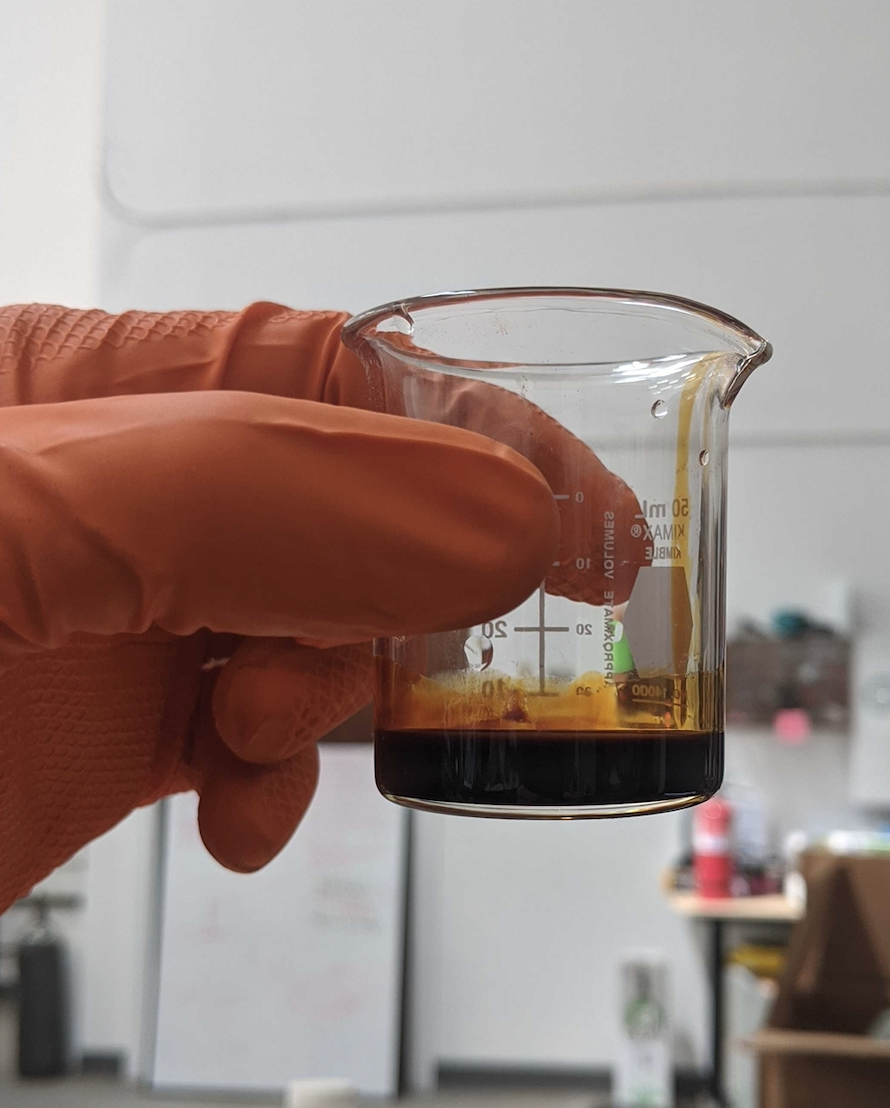

- How could efforts to decarbonize heavy industry reduce greenhouse gases? Technical interventions to reduce heavy industry emissions include switching to lower-carbon production processes (e.g., replacing fossil fuel inputs with hydrogen or direct electrification); carbon capture, utilization, and storage (capturing process emissions and storing them or converting them to value-added products); development of alternative materials (e.g., substitutions for cement and fossil-based plastic); and increasing material usage efficiency and adopting a circular economy approach.

- Theory of change for decarbonizing heavy industry: We think that supporting nonprofits advocating for governments to accelerate heavy industry decarbonization is a powerful lever for impact. We also think that supporting nonprofits working in regions with high heavy industry production is a promising strategy. Our impression is that some of these regions have less developed civil society ecosystems, and so individual nonprofits are likely to have a greater marginal impact. Specific philanthropic sub-strategies vary depending on the industry sub-sector, but we think the most promising sub-strategies increase research, development, and demonstration (RD&D) funding; low-carbon purchase commitments; or heavy industry policy support or regulation. We think that this would result in reduced production costs for low-carbon products compared to the counterfactual, and therefore more producers opting for low-carbon production.

- What is the cost-effectiveness of decarbonizing heavy industry? We developed a highly subjective, rough-guess cost-effectiveness analysis (CEA) to estimate the cost-effectiveness of efforts to decarbonize heavy industry (in terms of dollars per metric ton of CO2-equivalent reduced/avoided). As a proxy for these efforts, we estimated the effect that an advocacy campaign might have on increasing the cement emissions reduction targets of the US Federal Buy Clean Initiative, as well as such policies’ subsequent impact on cement emissions reductions worldwide. Overall, we think that efforts to decarbonize heavy industry could plausibly be within the range of cost-effectiveness we would consider for a top recommendation. Though we have low confidence in this CEA to estimate the cost-effectiveness of this specific philanthropic effort, we generally view it as a positive input to our overall assessment of decarbonizing heavy industry.

- Is there room for more funding? It is our general impression that philanthropic support for decarbonizing heavy industry has increased but continues to remain underfunded, at an estimated 2.6% of total foundation climate funding. Within heavy industry, certain subsectors and geographies are also comparatively underfunded, such as cement and chemical decarbonization and regions outside of the US and EU. Overall, we think this sector likely has significant room for more funding.

- Are there major co-benefits or adverse effects? We think decarbonizing heavy industry could significantly reduce local pollution. It could have unclear employment effects as global industries grow, shrink, and change due to decarbonization.

- Key uncertainties and open questions: In general, we are uncertain about the cost-effectiveness of R&D efforts, the efficacy of government funding support, geographic focus, general equilibrium effects, and heavy industry regulatory code.

- Bottom line / next steps: We have identified heavy industry as a priority impact area and therefore plan to consider organizations working on industrial decarbonization for both Top Nonprofits as well as grants from the Giving Green Fund. Heavy industry is a substantial contributor to emissions, and we think there are relatively high-leverage opportunities to affect government decision-making and increase the geographical diversity of actors working on heavy-industry decarbonization. We may expand the scope of our investigation in the future by focusing on specific high-potential decarbonization subsectors and generally plan to devote more research capacity to exploring organizations and initiatives that are based in countries where substantial future heavy industry production will be located.

This report was last updated in October 2024. This is a non-partisan analysis (study or research) and is provided for educational purposes.

Support Our Work

Giving Green Fund

One fund. Global impact. One hundred percent of your gift supports a portfolio of high-impact climate organizations, vetted by our research.

Best for:

Donors who want the simplest way to impact multiple climate solutions.

Top Climate Nonprofits

Meet the organizations on Giving Green’s list of high-impact nonprofits working to decarbonize our future, identified through our rigorous research.

Best for:

Donors who want to give directly and independently.

Support Our Work

We thoroughly research climate initiatives so you can give with confidence. For every $1 we receive, our work unlocks another $21 for effective climate solutions.

Best for:

Donors who want to amplify their impact through research.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.jpg)