Climate Impact Investing: Strategy Report

Executive Summary

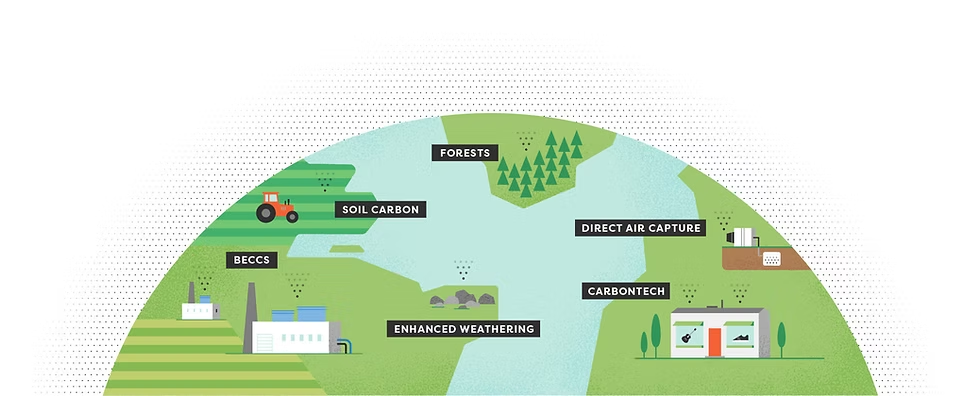

Impact investing is the practice of investing with the intention of achieving measurable financial returns and social and environmental impact. Impact investments can occur across industries, asset classes, and risk/return profiles. In this report, we highlight impact investments with the potential to reduce greenhouse gas emissions and contribute to the fight against the climate crisis.

Historically, impact investing has been the purview of institutional investors or wealthy individuals. We choose to focus on opportunities available to retail investors in the United States. (Occasionally, we offer a note on additional opportunities available only to accredited investors.) We consider investments occurring in three asset classes: early-stage private equities, cash equivalents, and fixed-income investments.

Private equity refers to direct holdings in private companies, and purchasing private equities, especially in early-stage companies, is often risky and inaccessible to unaccredited retail investors. Unaccredited retail investors can make limited investments of this type through a relatively new mechanism known as Regulation Crowdfunding. We discuss the potentially transformative impact of early-stage private equity investments and the significant risk associated with them.

Cash equivalents and fixed-income investments are more conventional, and offer many more opportunities for retail investors. These types of investments generally offer a fixed, low to moderate return in addition to repayment of the principal. We highlight a range of climate-related investment offerings, including savings accounts at climate-focused banks, notes offered by loan funds that make climate-related loans, and bonds offered by companies or municipalities looking to fund climate-positive projects.

We discuss a number of approaches to assess whether investing in a hypothetical project or firm has high potential climate impact. We focus on causality, or the reduction of atmospheric greenhouse gases attributable to the project, and additionality, or an individual investment’s contribution to increasing the impact of the project. While conclusions on impact cannot be perfectly generalized across an asset class, we observe some patterns. Startups promise transformative impact, but it is difficult as an investor to predict the likelihood of actually achieving that impact. On the other hand, cash equivalents and fixed-income investments usually have strong and defensible links to impact, even if that impact is limited in scope. We also note opportunities to invest for non-climate co-benefits, including economic development and providing financing to low-income communities.

Overall, we find that there are promising ways to invest for climate impact across all asset classes, but that navigating this terrain as a retail investor is complicated. At this time, we do not recommend that retail investors make any investments in individual projects or firms, whether via equity or debt instruments. We also do not yet recommend donating philanthropic funds to any investment firm. We found one low-cost, low-risk way to support existing capital solutions, though we do not yet formally recommend it: moving money to a bank that specializes in lending to clean energy projects.

We hope this report serves as a guide to the available opportunities to leverage investment capital for climate impact. We at Giving Green have barely scratched the surface of this wide-ranging and fast-growing industry, and we hope to continue to highlight new opportunities as we discover them.

This report was last updated in November 2021. It may no longer be accurate, both with respect to the evidence it presents and our assessment of the evidence. We may revise this report in the future, depending on our research capacity and research priorities. Questions and comments are welcome.

Support Our Work

Giving Green Fund

One fund. Global impact. One hundred percent of your gift supports a portfolio of high-impact climate organizations, vetted by our research.

Best for:

Donors who want the simplest way to impact multiple climate solutions.

Top Climate Nonprofits

Meet the organizations on Giving Green’s list of high-impact nonprofits working to decarbonize our future, identified through our rigorous research.

Best for:

Donors who want to give directly and independently.

Support Our Work

We thoroughly research climate initiatives so you can give with confidence. For every $1 we receive, our work unlocks another $21 for effective climate solutions.

Best for:

Donors who want to amplify their impact through research.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)